Civil society proposes to decrease the threshold for declaring beneficial owners for the extractive industry following a monitoring of law enforcement and an investigation into ownership in the extractive industry sector, such as chrome, copper, oil and gas, clay, limestone, bitumen etc.

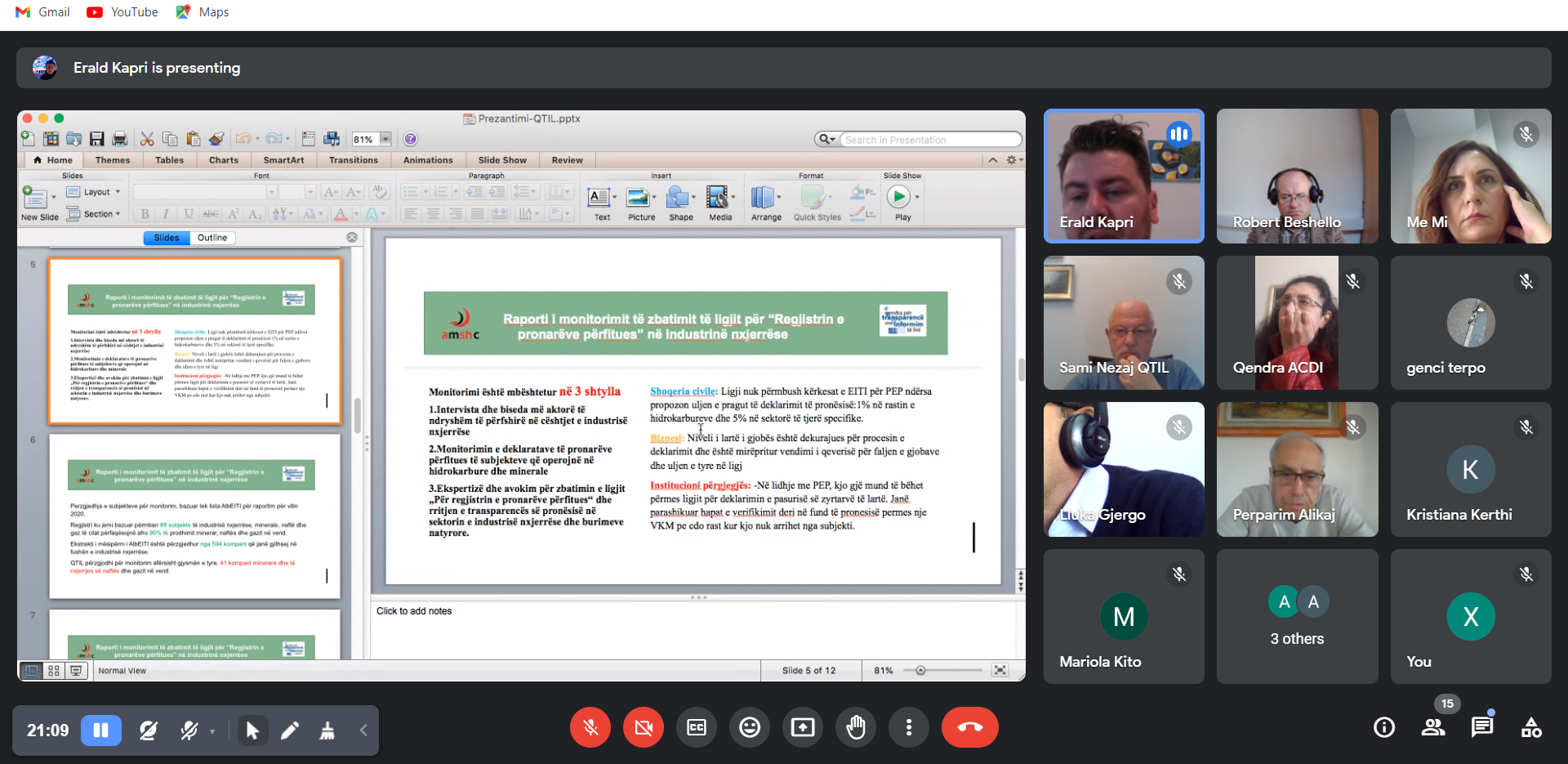

The Center for Transparency and Free Information (qTIL) has been monitoring for several months the implementation of the law "On the Register of Beneficial Owners" through the project entitled "The fight against corruption and increasing transparency in the use of natural resources through the implementation of the Law on the Register of Owners" Beneficiary".

The project supported by the Civil Society Support Agency has lined up several reasons and findings that, according to the director of qTIL, Sami Nezaj, make it necessary to amend the threshold in businesses related to the extractive industry.

Nezaj says that the first change is related to the ownership declaration threshold for companies in the extractive industry, which they propose to lower from 25% to 10%.

"For mineral companies, 30% of companies are indirectly owned (23 companies from the sample are directly owned, 7 companies are indirectly owned, mainly Turkish, Chinese, Dutch, French, Italian, Greek Cypriot. One Albanian company is registered in tax haven, Malta and another in Cyprus).

Nearly 30% of companies have undeclared ownership shares within the law but also in violation of the law. 23 companies have verifiable owners in the entire ownership segment, while 10 companies have unverifiable parts of ownership, in some cases within the limits of the law and in some cases beyond the legal limits," said Nezaj.

For Nezaj, ownership becomes more opaque in the oil sector.

"Out of 6 analyzed companies, 3 of them are registered in fiscal havens, while reading the extracts published on the pages of the CCA, it is not clear in 4 cases who is the owner of the oil companies in Albania.

The form in two cases does not show the percentage of ownership even in those cases where the name of the beneficial owner individual is highlighted.

In one case of direct ownership, the owner is not recognized for 10% (it is legal), in another, the owner is not recognized for 37.2%, in another, the percentage of the individual but also of the legal entity is not recognized; a company does not have data on the percentage of ownership, despite the fact that it is considered that the company has registered the ownership and it has been approved by the KKB", says Nezaj.

From the monitoring report it is learned that from 6 oil, gas and oil and gas exploration and exploitation companies, all of which represent indirect ownership; 3 of them are registered in tax havens, among which the owners of Bankers Petroleum, which have nearly 80 percent of the exploitation of oil reserves.

While in the entire extractive industry sector, nearly 5% of companies have been rejected in the declaration of beneficial owners. Monitoring has found that in the sample taken for review, a total of 42 largest companies in the sector, 2 companies have failed to report the beneficial owners, one of them is suspended.

Experience of other countries:

According to "The European Banking Federation (EBF)" there is a proposal by the European Commission to introduce a new regulation for the harmonization of the Anti-Money Laundering Regulation, where it is proposed to reduce the threshold percentage that serves as an indicator of ownership from 25% to 5% .

For this reason, a number of countries have already, since 2020, applied lower thresholds in their national legislation for Beneficiary Persons (PP), such as Argentina (1 share or above), Senegal (2%) Nigeria (5 %), Paraguay (10%), Kenya (10%), and the Cayman Islands (10%), etc.

Extractive industries have been identified as specific sectors that pose a significant risk of corruption. Setting low thresholds ensures that a greater number of beneficial owners (BPOs) are disclosed to law enforcement. Armenia moved from a 20% threshold for Beneficial Owners (BPOs) in its 2008 law to a 10% threshold for mining sector disclosure in 2019. Similarly, Liberia adopted a threshold of 5% for mining, petroleum, Ghana has adopted a 10% threshold locally for all registered extractive companies while foreign extractive companies operating in Ghana will be subject to a 5% declaration threshold.

The monitoring of the implementation of the law was done through a sample of 42 extractive industry companies filtered out of about 594 companies operating in the sector as well as legal expertise and desk research related to the sector. A. Bega

"This publication, has been made possible with the financial support of AMSHC. Its content is the responsibility of the author, the opinion expressed in it is not necessarily the opinion of AMSHC"